Charity Donations in Canada & Taxes: How Much Can I Get Back?

Our Toronto-based tax accounting clients often ask us, “How much money do you get back for charitable donations?” That, of course, depends on a lot of factors.

However, Canada Revenue Agency (CRA) is making it easy for you to calculate exactly how much you can receive in tax credits for your charitable donations. Their website now features a Charitable donation tax credit calculator.

According to CRA:

“This calculator lets you estimate the amount of tax credit available for eligible donations claimed on an income tax and benefit return for a tax year, by province or territory of residence. It does not take into account all possible tax situations.”

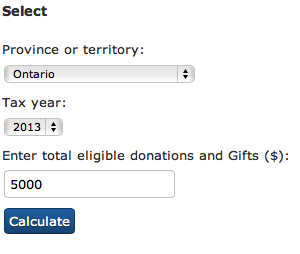

It’s very simple to use. Just enter your province or territory, the tax year and the total eligible donation and gifts. It will then give you the amounts you can expect for federal, as well as provincial or territorial tax credits.

There is also an additional federal tax credit calculator for first time donors, for people who might be eligible for the new First-Time Donor’s Super Credit.

The calculator is not intended for corporations or Alberta residents with unclaimed donations and gifts for the years 2004 to 2006 (line 5895 of Form AB428, Alberta Tax and Credits). Also, Quebec residents that are entitled to a refundable federal tax abatement, will see the actual federal tax credit reduced.

If you have any questions about tax services and accounting in Toronto, please feel free to contact our accounting firm for more information.