How Long Do I Have to Keep My Business Tax Records?

It’s a simple question, but one you’ve probably heard different answers for. As a business owner, how long do you have to keep your tax records? Is there a statute of limitation of how far back they can go to audit you?

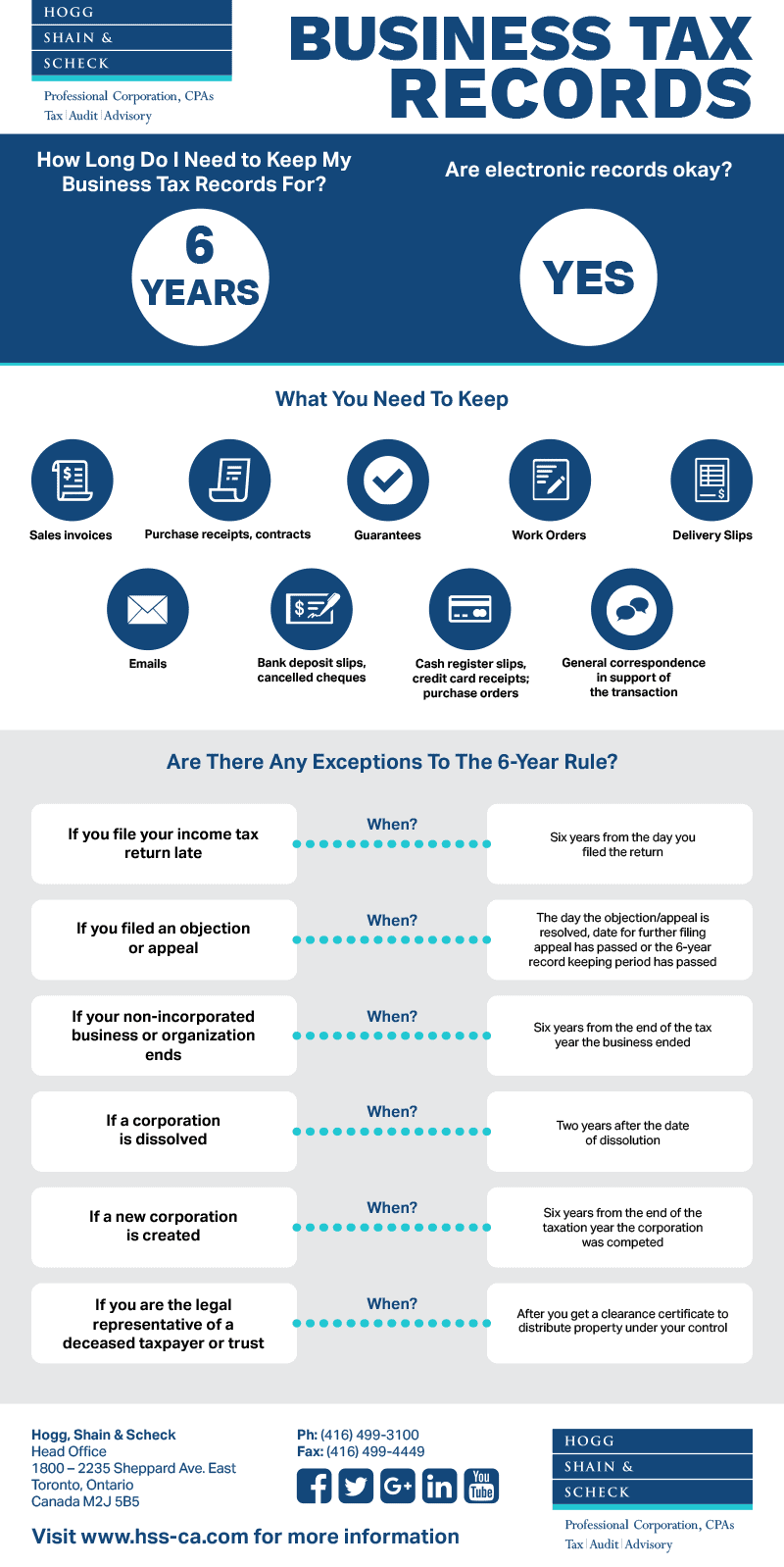

Well, here’s the answer, straight from the source. According to the Canada Revenue Agency, “if you file your return on time, keep your records for a minimum of six years after the end of the taxation year to which they relate.”

Check out this infographic we’ve put together to illustrate what you need to know about your business tax records.

Download our infographic and whitepaper on business tax records here.